Some companies don’t really know the value of a seamless payment experience, and that’s why they have a high cart abandonment rate (You can read our article about cart abandonment rate here). To avoid that daunting prospect, we would like to give you six ways to improve your payment process. Check it below!

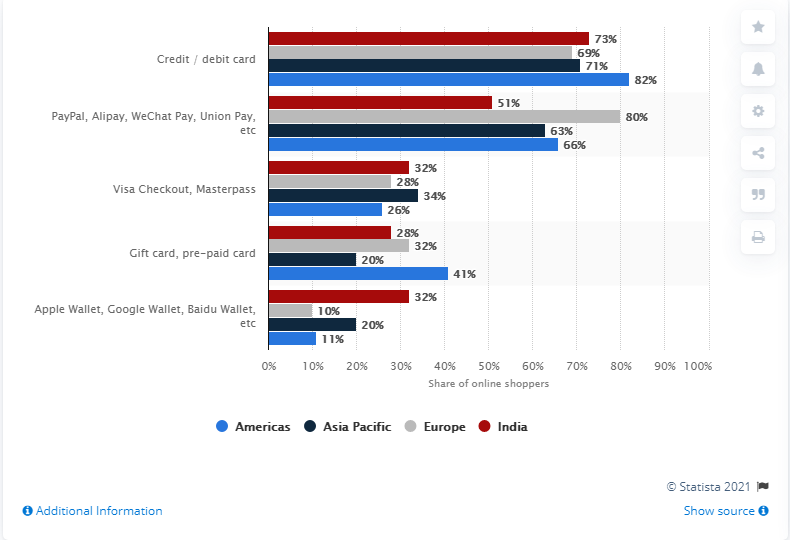

Increase The Number of Payment Choices

Not everyone has a PayPal account, or not all of us would like to use the credit card online. If you aim at selling products for customers all over the world, you’d better provide them with as many payment choices as possible.

Statista's statistics on the preferred payment method of each region

There are three ways to find out what payment choices should be included in your online store, which are:

- Looking at the data to see most selected payment choices

- Creating a poll on social media (like Facebook)

- Creating a survey and sending it to your email subscribers

Eliminate Pop-Ups, Opt-Ins And Social Media Icons

You can grow subscribers with opt-in forms, and you can get access to more users on Instagram through social media icons. However, the payment page is the only place for handing money, not to advertise your store or brand.

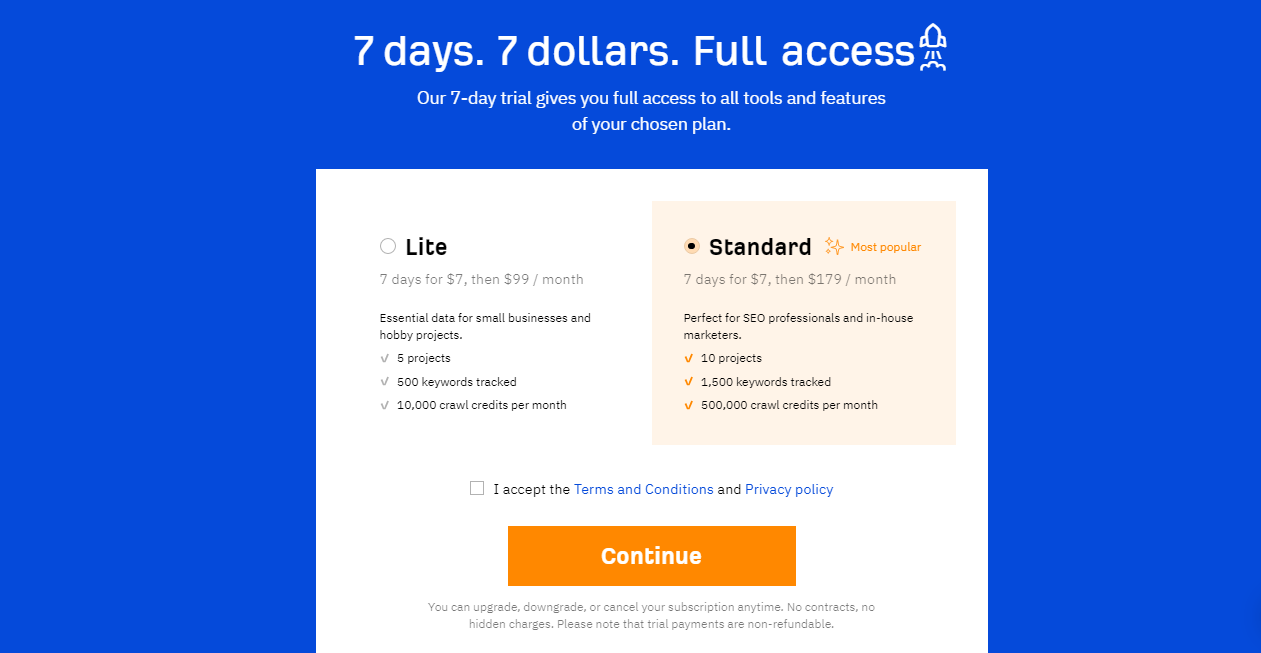

At this stage, all attention should be put on the pricing, the trial you offer, and the completion of the payment process. Ahrefs does the same when the payment page directly informs the trial and doesn’t include any spams:

Minimize The Number of Detailed Questions

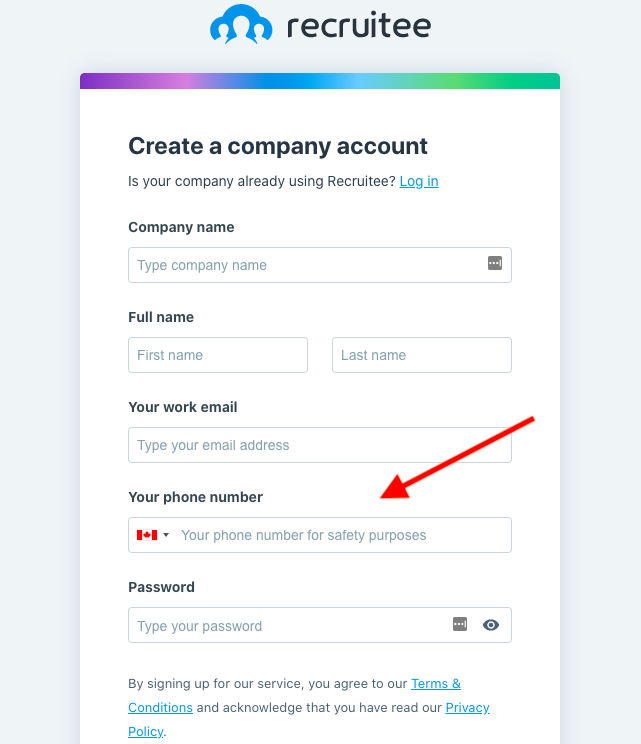

Is it really necessary to know your customers’ date of birth, their homeland or the number of ID cards? I guess not. If you require the shoppers to fill in too many fields, there is a likelihood that they will leave your site immediately.

Remember that “Less is More”. Just ask for the information you need and explain why you need them. For example, Recruitee takes note that they need customers’ phone numbers for safety purposes, as the picture below:

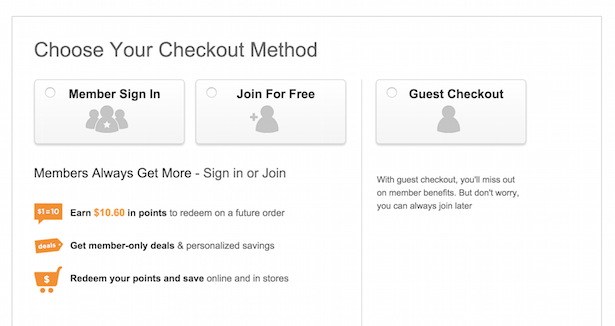

Allow Customers To Check Out As A Guest

Many apps and websites (like Amazon or eBay) don’t allow customers to check out until they create an account. That’s the privilege of big brands. However, it would be different if you just own a new and small business.

One suggestion is to allow users to check out as a guest, yet still, encourage them to create an account by offering small discounts or some benefits. Take a look at how Sears does it:

Showcase Your Trust Badges

Some stores might not offer COD (cash on delivery), while many people (especially the elders) feel cautious with the idea that some websites are entering their bank details.

To make them feel more secure and comfortable, you can showcase the trust badges on the check-out page. It can guarantee money back, a safe checkout-out page or a free return, depending on what you can do for your customers.

Provide Recurring Bills Option

Some subscription-based service needs to bill consumers each month, which means that consumers have to log in at least once a month to make the payment. It’s a little bit time-consuming and annoying. Therefore, providing recurring bills will make your shoppers feel happier and more convenient.

To make consumers more comfortable, you can send a reminder before debiting their money - just like Netflix. After the 30-day trial, it will send an email about next month’s billing so that customers can decide whether to use the service or not.