On July 1st, 2021, the European Union (EU) will make a change to the value-added tax (VAT) rules, which will definitely create an enormous impact on sellers who sell across EU borders (known as distance sellers) and businesses that export goods to consumers in the EU.

This article will give you some significant changes and their effects on merchants whose customers live within the region. Check it below!

Changes to Sales of Goods within EU

Remove the Rule of Distance Selling Thresholds

At the time being, when EU merchants sell in other countries and reach a certain threshold (for example, €100,000 in Germany or €35,000 in France), they need to register for VAT in that country.

From July 1st, those distance selling thresholds will be removed. Instead, cross-border merchants will charge the VAT rate in the buyer's countries from the first sale, unless applying the micro-business threshold.

Set the New Threshold for Micro-Business

For EU micro-businesses with sales not exceeding €10,000/ year (during the last two years), merchants continue to charge the VAT rate of their country, no matter which EU countries they ship to. Besides, they will continue remitting to the local tax authority.

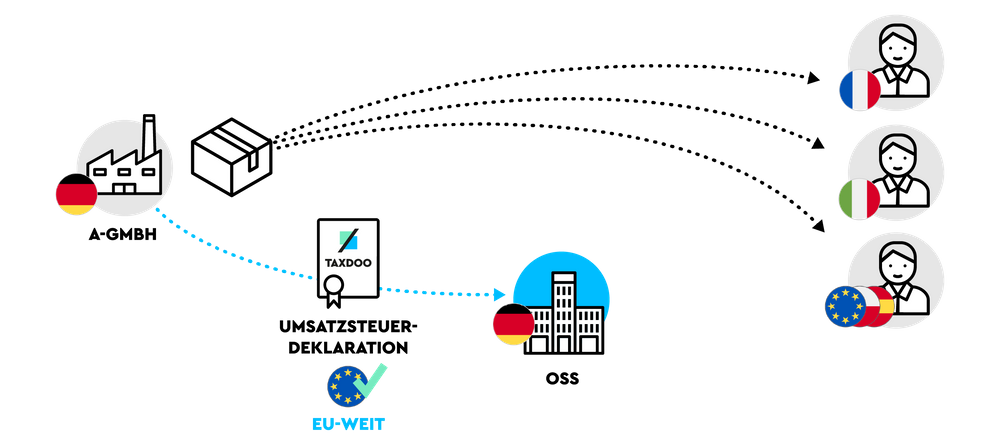

Introduce the OSS (One-Stop-Shop) Filling

For merchants who sell in multiple EU countries, they can file a single VAT return named OSS filing - which doesn’t ask them to individually register for tax in those countries. In other words, OSS makes the filling process easier and saves merchants from the troubles of registering in different countries.

OSS can be used to file and remit VAT for every country merchants ship to, as long as they don’t live there or have stock at the destination. If you belong to the situation mentioned before, you’d better continue to file a local return.

Through the domestic OSS portal, merchants have to hand out an electronic quarterly VAT return and make sure that they keep records of OSS sales for 10 years.

Changes to Businesses that Export Goods to EU Buyers

Set New VAT Threshold for Imports

At the time being, every importing consignment under €22 is granted exemption from VAT. This will change on July 1, 2021, which means that all of the consignments up to €150 will have to pay import VAT.

If consignments have low value, online merchants can choose to collect VAT at the point-of-sale instead of paying import VAT. For the DDU (Delivery Duty Unpaid), customers will have to pay import VAT. They will have postal operators or customs agents pay this fee and some additional brokerage fees for them.

For €150 imported goods supported by OMP (Online Marketplaces) platform, the OMP platform will have legal responsibility for VAT of those sales. One thing to note here is that Shopify does not play the role of the OMP platform.

Introduce the Import One-Stop-Shop (IOSS) Filing

IOSS is not compulsory and is applied to non-EU merchants. Merchants collecting VAT on low-value goods can use IOSS to file a monthly VAT return for every exporting goods to the EU. It is recommended that those merchants had better appoint one fiscal representative for them.

We will continually update how Shopify will simplify your EU taxes. While waiting for that, you can check some tips to manage the inventory effectively when doing business on Shopify.