Paying income tax is the right and obligation of all citizens. Because taxes are a great source of revenue for the state budget to ensure social welfare for the people. However, each country and territory has different tax calculation methods depending on their policies. In this article, we will show you how to calculate tax in Europe.

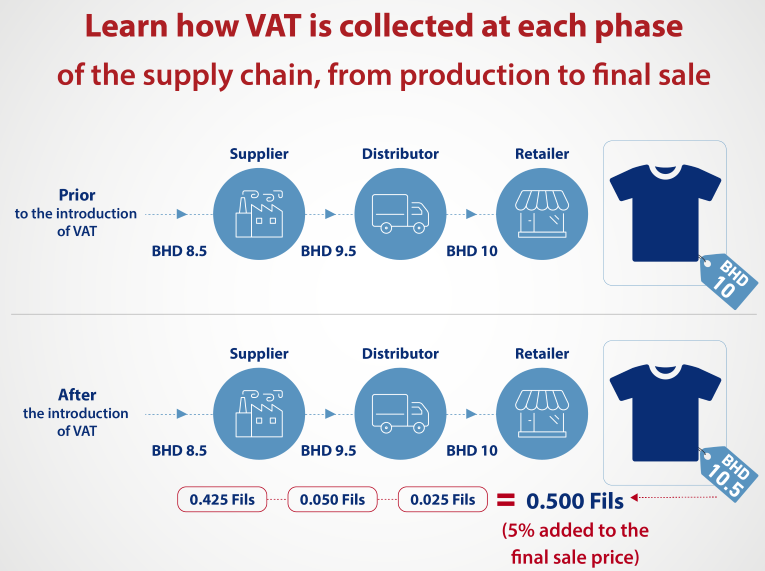

What is VAT?

The VAT number, also known as a Value Added Tax Number (VATIN), is an identifier used in the European Union. This number is issued to you by the member country's tax authority after you have registered with them. Countries issue this code to allow traders to collect value-added tax.

Normally, if you intend to sell to other countries in the European Union, you need to register with the tax authorities in your country to collect VAT.

What rate is the VAT collected?

The VAT rate is determined according to the customer's location.

- Customers in your country of residence will be subject to your country's VAT rate.

- For customers in the European Union countries outside your home country, tax rates are determined based on whether or not you exceed the tax registration threshold. - If you do not exceed the threshold, your customer will be subject to VAT in your country.

- If you exceed the threshold, your customer will be subject to VAT in the customer's country. To collect the VAT rate for the target country, you'll need to register a VAT code with that country.

How to apply tax in a European Union country?

If you need to register for tax collection in a European Union country, you can contact that country's tax authorities.

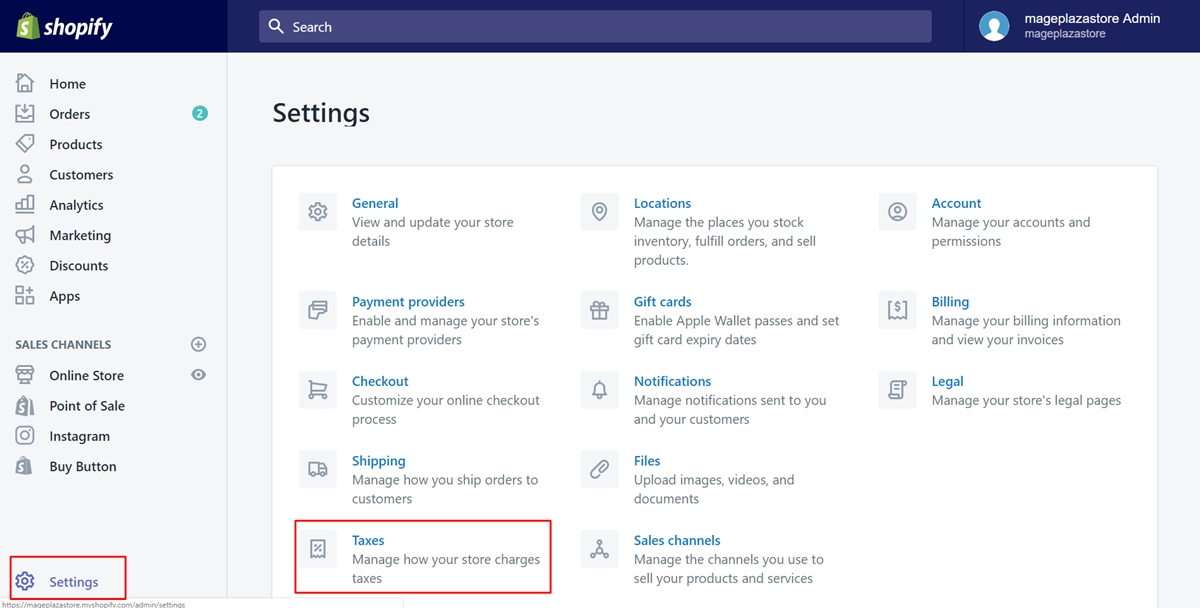

Once registered, add your VAT number on the Taxes page as follows:

1. On the Shopify admin page, go to Settings> Taxes

2. In the Tax regions section, next to European Union, click Set up

3. In the VAT collection section, click Collect VAT.

4. Select the country where you are registered.

5. In the VAT number, enter your VAT number.

6. Finally, click Collect VAT.

Tax rounding in Europe

In the past, the tax was rounded up to the invoice by calculating the tax on the order's subtotal and then rounding the result. After you update your settings to use the European Union tax feature, the tax amount is rounded up by line item. In this case, the total tax value is calculated by applying the tax rate to each line item in the order, rounding up the result, and then adding these subtotals to get the total value of the order.

Rounding tax by line will improve the calculation of different tax rates and make it easier to calculate tax on orders with both taxable and non-taxable products.