The global business-to-business e-commerce market was valued at USD 5.7 trillion in 2019 and is predicted to increase at a 17.5 percent compound annual growth rate (CAGR) from 2020 to 2027. Customers are increasingly turning to internet shopping as a result of the ongoing COVID-19 pandemic, which has forced brick-and-mortar stores to close. The epidemic has had a significant impact on major economies like the United States, China, India, and Italy. As a result, regions such as Europe and North America are expected to see a significant impact on the market. For example, according to data from Emarsys and GoodData, revenue has increased by 37% and orders have increased by 54% in the United States since January.

Overview

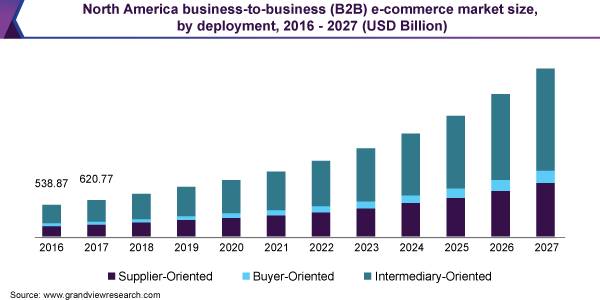

The chart of B2B e-commerce market size by deployment, 2016-2027 by Grand view research

The rising preference of businesses for e-commerce platforms to establish an online presence, as well as the convenience with which they can conduct business, are expected to propel the market forward. By automating labor-intensive and manual procedures and providing consumer self-service alternatives, business-to-business (B2B) e-commerce helps organizations cut costs and enhance productivity.

Furthermore, B2B eCommerce solutions automate trading operations and expand business collaboration prospects with suppliers and distributors.

Buyers and sellers can place and handle orders from their mobile devices using B2B eCommerce platforms at their leisure. Furthermore, B2B e-commerce encompasses a wide range of inter-company interactions, including wholesale trade, manufacturing, and distribution, Purchases of manufactured components and parts are also possible. As a result of the numerous benefits given, such as lower infrastructure and administrative costs for enterprises, as well as the elimination of the need for middlemen, the market's growth prospects are likely to improve throughout the forecast period.

Insights into Deployment

With a revenue share of 58.4 percent in 2019, the intermediary-oriented category dominated the business-to-business e-commerce industry. The intermediary-oriented approach is made up of a platform that allows buyers and sellers to communicate and do business with each other. The successful transactions which the suppliers and buyers finish will create profit for intermediary platforms. Alibaba.com, Amazon.com, Inc., and eBay Inc. are three major enterprises that operate through intermediary-oriented platforms.

Alibaba – one of three major e-commerce enterprises

During the forecast period, the supplier-oriented segment is expected to grow at a significant CAGR of over 17.0%. The existence of a large number of providers on a similar web platform is credited with this increase. Furthermore, a number of suppliers have established an online marketplace in order to offer a more efficient route for selling to a big number of firms. As a result of the availability of various suppliers offering a diverse range of products, the category is expected to grow.

Insights into Application

The home and kitchen sector dominated the market in terms of revenue in 2019, with a share of 20.9 percent, owing to rising demand for this product among end-users, which has led to rising demand for these products among suppliers/buyers. The market has been divided into categories based on application, such as home and kitchen appliances, consumer electronics, industrial and science, healthcare, clothes, cosmetics, and personal care, sports apparel, books and stationery, automotive, and others. The market has been divided into categories based on application, such as home and kitchen appliances, consumer electronics, industrial and science, healthcare, clothes, cosmetics, and personal care, sports apparel, books and stationery, automotive, and others.

Products are grouped by their application

Meanwhile, during the projection period, the consumer electronics segment is expected to grow at a significant CAGR of over 16.5 percent. Suppliers and buyers can examine a comprehensive portfolio of items, get discounts, and apply for quick returns on a B2B eCommerce platform, which opens many channels for the sale of electronic products. Similarly, the garment industry is expected to see tremendous expansion.

Regional Perspectives

In 2019, Asia Pacific dominated the market with a 66.4 percent share. The increase can be attributed to the region's growing number of business-to-business e-commerce enterprises. Furthermore, the proliferation of online providers and customers across the region is attributable to the increased adoption of smartphones, which has resulted in the spread of internet connectivity. The number of smartphone devices in Asia Pacific is predicted to reach 3,900 billion by 2025, according to the GSMA.

More technologies will be applied to flourish e-commerce industry

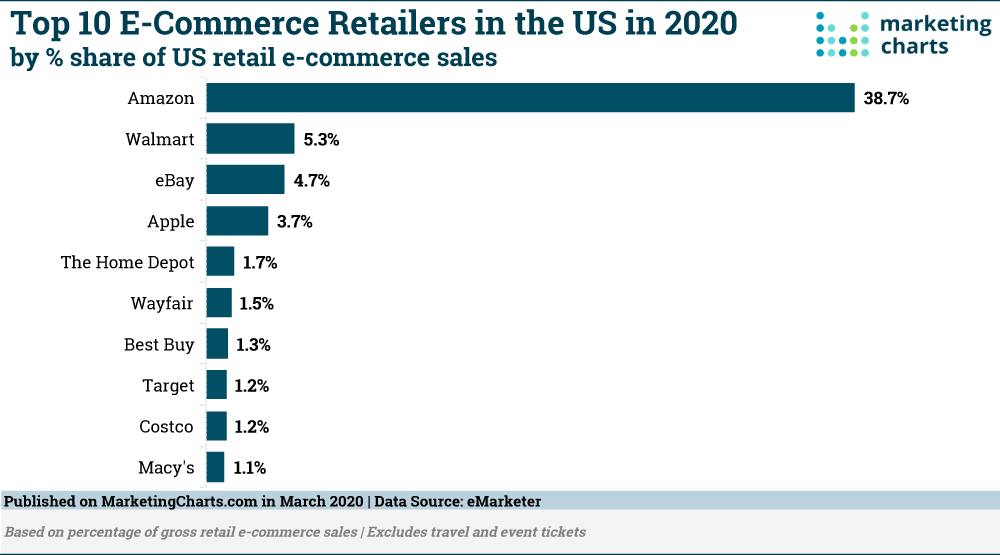

From 2020 to 2027, North America is predicted to grow at a significant CAGR of over 16.0 percent. The presence of large businesses such as Amazon.com, Inc., eBay, Inc., and Walmart are credited with this expansion. These businesses are incorporating innovative technologies into their online platforms, such as chatbots and same-day delivery. Furthermore, demand for B2B e-commerce is predicted to rise throughout the projection period, owing to the expansion of cloud services and successful B2C experiences, which are driving demand for B2B e-commerce.

Insights into Key Companies and Market Share

Because there are so many small and medium-sized businesses operating globally, the market is highly fragmented. Amazon.com, Inc., ChinaAseanTrade.com, DIYTrade.com, and Flipkart.com are the key global participants in the business. To stay competitive, companies are concentrating their efforts on mergers, acquisitions, and joint ventures or collaborations to improve their competitiveness.

Top 10 e-commerce retailers in the US in 2020

Furthermore, the businesses are concentrating on improving their market presence by implementing various growth strategies that will allow them to extend their business regionally and improve their products in a certain location. In addition, as part of their growth plan, businesses are focusing on providing a better user experience. The following are some of the most well-known market players:

- Amazon.com, Inc.

- eBay Inc.

- Flipkart.com

- IndiaMART

B2B E-COMMERCE IN COVID-19

COVID-19 has transformed everything, and manufacturers are flocking to B2B e-commerce as a result.

Due to COVID-19, McKinsey & Company recently remarked on the increased tendency of purchasers to prefer self-service. Customers' preferences are evolving, and B2B leaders are taking notice: Self-service is now more important to customers than traditional sales engagements, according to 66 percent of B2B decision-makers questioned, up from 48 compared to the past.

Let’s take a closer look at what COVID-19 has brought to us and to e-commerce merchants in particular by this article: “How does COVID-19 affect e-commerce?”.

Apparently, the above are a couple of aspects of the wholesale e-commerce market. There would be more and more comments on the changes of the B2B e-commerce industry in the last year as well as the forecast in the future. If you have any opinions, leave a message here, then we can talk!

1 comment

I recently completed my digital marketing course at Maximum Learning, and it was an incredible experience! The academy’s curriculum is thoughtfully designed and covers everything from SEO and social media to PPC and analytics. The instructors are true experts, blending theory with real-world applications, which made learning both practical and engaging. The hands-on projects were particularly beneficial—they gave me confidence and valuable experience working on real campaigns. Maximum Learning’s commitment to quality and student support, including career guidance, really sets it apart. I’d highly recommend this academy to anyone looking to build a strong foundation in digital marketing!